MORTGAGE CALCULATOR EXTRA PAYMENT PRINCIPAL PLUS

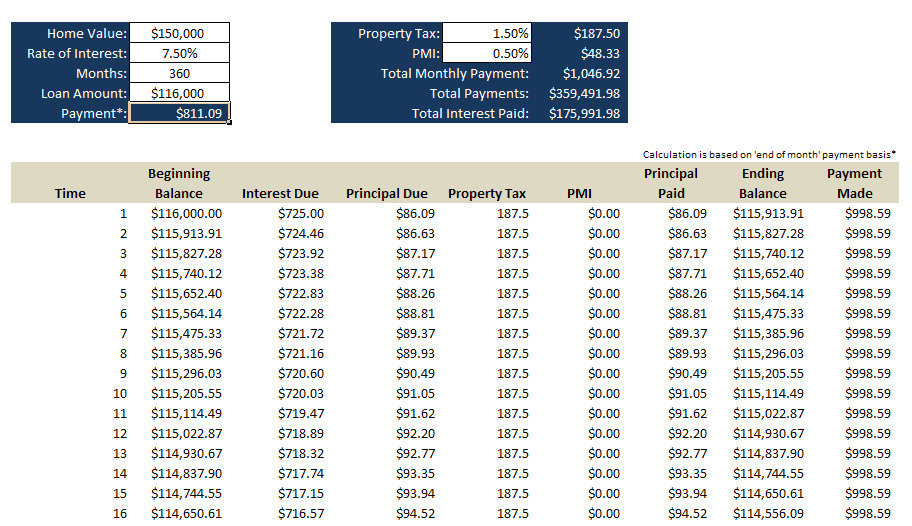

New Monthly Payment: The required ‘Monthly Payment’ plus any ‘Additional Principal’ you want to pay each month. Depending on the type of loan, your actual payment may include other amounts for escrow, private mortgage insurance (PMI), fees, or property taxes.Īdditional Principal: The additional amount you will pay each month (over the required ‘Monthly Payment’ amount) to pay down the principal on your loan. This may not be the amount you write a check for each month. Monthly Payment: The principal and interest portion of each monthly payment. Interest Rate: The annual percentage rate you are paying for this loan. Loan Balance: The amount you owe on your mortgage or loan. This field is not required but may help if you have printed out several loan scenarios. Lender: The name of your potential lender. Title: A title for these calculator results that will help you identify it if you have printed out several versions of the calculator. The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. You can save a lot of interest if you pay down the loan early.This extra payment calculator is designed to tell you how much interest and time you’ll save if you know how much extra you can pay each month.

An additional $50, or even $25 extra principal each month may make a surprising difference. You don’t have to pay a lot of extra each month to make a significant difference in your loan payoff time. One of the most common ways to pay down a loan early is to pay additional principal each month. (Thanks user Jeff for noticing and pointing that out!)Ī Good ‘Pay Down Loan’ Strategy is to Pay Extra Principal Every Month Accurate data to begin with gives an accurate answer. This one is smart enough to take that into consideration and use only your current balance, loan rate and payment amount.

If you have, your balance will not match and your answer will not be accurate. They assume you have not made any additional payments to your principal. Almost every other loan pay off calculator out there uses initial loan amount, rate, date and term of loan.

If you want to pay down a loan ahead of schedule by adding a fixed amount to each payment, this extra payment calculator will show you how much quicker you’ll reach loan pay off time and how much money you’ll save. How will my existing mortgage be affected if I make extra mortgage payments to pay down the mortgage?

0 kommentar(er)

0 kommentar(er)