#Acorns investment app how to

Is Buying a House a Good Investment? How to Start in Rental Properties How to Start Flipping Houses How to Invest in Real Estate Remotely.View All Brokerage Platforms Best Roth IRA Account Providers.Combining the two issues, Acorns customers lose access to their money, sometimes when they need it most, while still being charged fees.

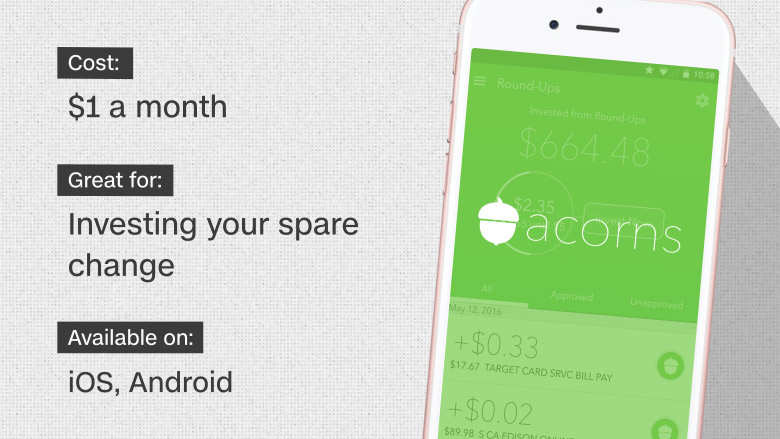

Customers have reported instances of poor communication and slow responses, with some finding it so unreliable they said it feels like a scam.Īnother major problem is the locking of accounts, which has happened to multiple customers who then have to go through customer support to get help. The trend seems to be with the newest reviews from the past year, which are incredibly skewed toward the negative.Ĭustomer service is one of the primary complaints, from getting help with technical issues to canceling a subscription or closing an account. Skyrocketing negative reviews on Trustpilot: Acorns once held a Trustpilot score nearing 5.0, but when you go there now, it has an abysmal 2.2 rating. However, it might have stretched itself too thin, with customers noticing a definite difference between the Acorns of old and its current form. The neobank offers a lot, and it is still looking to expand further. Shifting model: Acorns has also been shifting its model for quite some time, becoming a more comprehensive financial provider. The terminated merger not only stopped the company’s IPO, but it had to pay a $17.5 million fee. But the valuation only reached $1.9 billion, 13.6% lower than the $2.2 billion valuation given during a terminated SPAC merger. Recently reduced valuation: In March of 2022, Acorns raised $300 million in funding, which should have been a cause for celebration. There is also no tax-loss harvesting or human advisors, and users have little to no control over investments, which is not for everyone. Additionally, there are fees to access the checking account, which is not something seen in other top platforms. However, the fees can be high, depending on the total balance of an account.

Moreover, the easy-to-use nature of the platform expands to the interface. Successes and failures of the platform: The comprehensive platform does have some upsides, such as making investments easy and offering risk-appropriate, low-cost investment portfolio options. The family account is $5 per month, but it gives users access to everything from the personal tier and an early investment account for kids. The personal account is $3 per month and comes with all the features offered, such as investment and retirement accounts, banking, and bonus investments.

#Acorns investment app free

0 kommentar(er)

0 kommentar(er)